It is a financial product that can help to secure your family or other loved ones financially. However, when setting up the protection that will enable you to get this shield, your premium is determined by factors. Knowledge of these aspects may allow you to make proper choices that will, in the long run, reduce the amount of premium you require for your life insurance policy.

In this article, we’ll explore the some key factors that raise life insurance premiums, backed by real-world insights and tips to manage these costs effectively.

Table of Contents

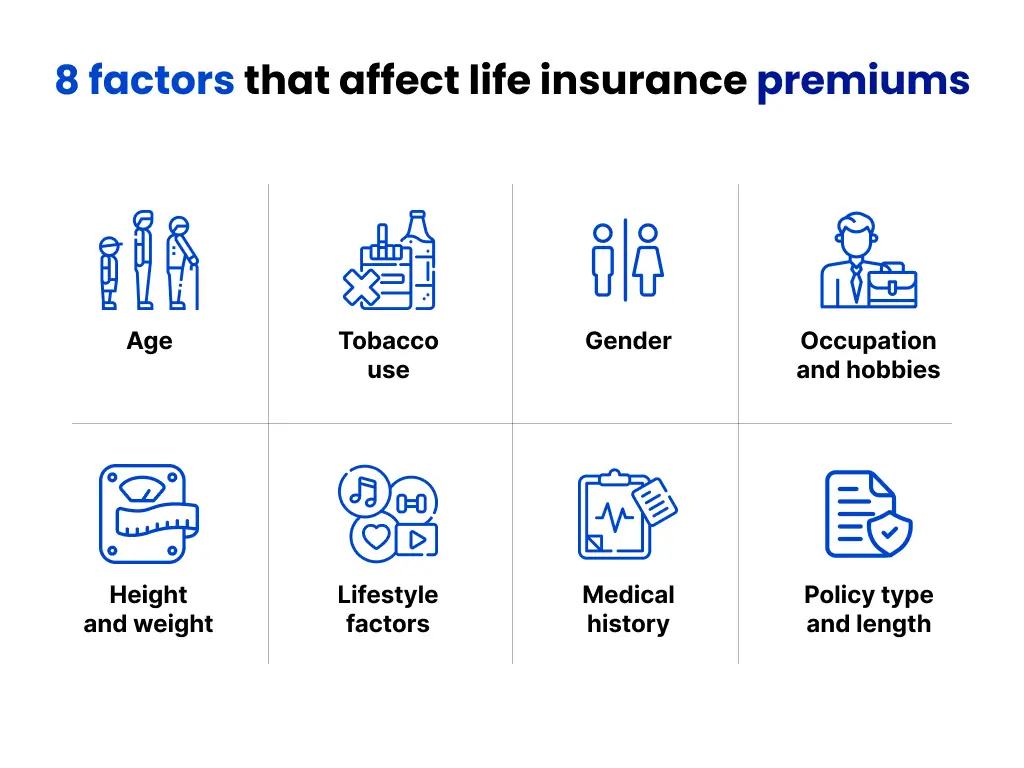

Real-life Factors That Raise Premiums

1. Age

One of the main factors influencing the cost of your life insurance is most likely your age. They are costly, premiums are determined by life expectancies, and the likelihood of a health issue increases with age.

Pro Tip: Though the rates of the life insurance policies are cheaper when locked at a young age, therefore, you should lock in the insurance policy at this young age. A large number of companies have relatively affordable ratings for people at the age of 20 or 30 years old.

2. Health Status and Medical History

Your general health and past medical history also influence the premiums greatly. Lifestyle diseases, including diabetes, high blood pressure, or heart complications, are usually costly. This approach can demonstrate that even the most insignificant conditions may influence the rates.

Example: About 61 percent of insurance companies pointed to cardiovascular problems as the leading ailment that leads to the hike in premiums, a survey conducted by the American Heart Association has revealed.

Actionable Advice: Taking normal health check-ups, having a proper healthy diet, and minimizing the dangerous health symptoms show insurers that you are lowering your risks.

3. Smoking and Substance Use

This vice is one of the most expensive when it comes to determining life insurance rates. Due to such diseases likely to affect smokers, such as cancer and heart diseases, they can be charged fifty to a hundred percent more than non-smokers. Also, different offenses attract different rates, and someone who is a substance abuse offender will pay far more than someone who is an initial offender.

Data Point: Today’s CDC draws attention to the fact that smoking is now a major risk factor since it is stated that it is responsible for 480,000 deaths in the United States alone per year.

Solution: Stay away from cigarettes or avoid using alcohol before applying for a life insurance policy. There are cases when applicants who have been nonsmokers for at least a year are offered cheaper insurance.

4. High-Risk Lifestyles

If you have lots of enthusiasm for such activities as skydiving, scuba diving, and other adventurous activities. These hobbies may interest you, but they do not interest insurers. Risk activities enhance the incidences of mishaps and thus lead to a high insurance rating.

Quick Fact: Recounting, it emerged that, as reported by the Insurance Information Institute, lovers of extreme sports are very likely to be charged extra on their policies.

Tip: It may be advisable to cut high-risk activities or temporarily suspend them while getting your policy to get standard rates.

You May Like

Role of Insurance in Healthcare in 2024

These 5 Types of Insurance Everyone Should Have

5. Dangerous Occupations

Some occupations are more dangerous than others by their very nature—construction workers, miners, or pilots take more risks at work than office clerks. Employers use these risks to determine your premium payments, even if they are unrelated to the line of work.

Example: A survey of occupational injuries conducted by the U.S. Bureau of Labor Statistics shows the logging and fishing industries have the highest risk rates, making it expensive to insure anyone in those categories.

Advice: If you are in a high-risk employment position, compare quotes from different insurance companies that deal with insuring such positions.

6. Family Medical History

It means that even if you are in perfect form, genetic predispositions involving illnesses such as cancer, diabetes, or heart disease will lead to a higher premium. Currently, insurers consider hereditary disorders a possibility of getting a disease later in life.

Pro Tip: This is a condition you are born with; however, aspects like exercising and getting checkups are things that you must keep on doing.

7. Policy Type and Coverage Amount

The type of insurance policy term life, whole life, or universal life also has a big bearing on premiums. In the same manner, the higher the coverage amount, the higher the amount you will pay.

Quick Breakdown:

- Term Life: Less expensive compared to many forms but only valid up to a certain time frame, such as 10, 20, or 30 years, etc.

- Whole Life: The cost is slightly higher but gives lifetime benefits with an additional option of cash value included.

Strategy: Analyze your needs carefully. If you require coverage for only a particular period (as in until the children are economically self-reliant), then go for term life to reduce costs.

8. Weight and BMI

Obesity causes overall health risks of incidences like diabetes and joint or cardiovascular issues; hence, their premiums are normally higher than for normal-weight people.

Statistic: The CDC defines obesity as about 42% of American adults and considers them high-risk by insurers.

Solution: Adults need to select a physical activity program and work to achieve a good body mass index. Of course, it is important to note that insurance premiums can be adjusted once you show some improvement in your health state.

Tips to Lower Life Insurance Premiums

- Compare Providers: There are various websites such as Policygenius whereby you can compare different rates and also choose the best one.

- Bundle Policies: However, some insurance companies give some kind of discount on having life insurance as well as having home or auto insurance.

- Opt for a Medical Exam: Although no exam policies will undoubtedly attract more people, medical exams and work-up plans tend to cost less.

- Pay Annually: One way of cutting down on expenses is to pay your premiums at one time annually instead of annually, more monthly.

Conclusion

Awareness of what influences life insurance premiums is beneficial; whenever the roles are reversed, it’s important to understand why things are the way they are. Some are still genetic (age and family history); health, lifestyle, and policy selection factors are well within your control. This is a clear sign that when you make the proactive move, you can get the type of financial protection your family needs at a cheaper price.

FAQ’s by Emma

What can I do to reduce life insurance rates with my health issues involved?

You can also reduce your premiums by keeping yourself in good health, following your doctor’s advice, and properly controlling your illness. Some insurers may also lower premiums if you show marked overall changes in health throughout the years. Selecting a policy from two or more providers and comparing the rates will enable one to make a decision based on the health status of the person.

Does kicking smoking habits instantly reduce the amount I am charged to pay for the life insurance?

Not immediately. Three out of five insurance companies expect you to be a non-smoker for at least one year before they can consider you so. But as soon as you give up smoking and stay a non-smoker, you can apply for a policy change, which may mean lower rates for you.