Table of Contents

Some of the tax proposals he vowed to undertake if elected in his 2024 presidential bid include repealing taxes on tips, overtime pay, and Social Security benefits, among others. As for such proposals, there is a rather vivid and growing debate about the feasibility of such measures in terms of costs for the federal budget, yet these proposals could draw attention to their possible effects on the income of workers.

It was implied that Trump’s plans would create individual and overall well-being in the United States economy. Nevertheless, details of how these proposals will be funded in the first place without negatively impacting the budget significantly seem to be elusive. His prior tax measures, including the 2017 tax reductions, are also up for expiration soon; hence, tax policy is one of the core legislative themes in the future years. Given another four years in office, Trump might try to introduce new taxes to Congress, but passing a new tax may be tough, especially when Democrats control either house.

Below is a breakdown of Trump’s key tax proposals:

1. Tax Exemption on Tips

On June 10, 2024, Trump said that he wanted tips to be exempt from federal taxes and went on to say that he had talked to a worker at one of his hotels in Las Vegas. He said that it would help people working in the service industry, particularly workers in states with unified rates such as Nevada. Trump said he would repeal the income tax on tips but was unclear if that also included abolishing both the payroll taxes, which pay for Social Security and Medicare.

2. Social Security Tax Relief

The Trump administration has also proposed the repeal of taxes on Social Security income. In the present time, all the beneficiaries receiving personal benefits or pensions of an amount above particular limits are only liable to pay federal taxes on such benefits. Some critics believe that repealing these taxes would lead to a faster rate of depletion of the Social Security trust fund, decreasing benefits to the funded amount by 2033.

3. Overtime tax cuts

In September 2024 again, Trump promised to abolish taxes on overtime pay. He stated that this would encourage workers to work more for extra hours and allow companies to recruit for shifts. Again, as with nearly every one of his proposed changes to the tax code, the overall budgetary effect of this plan remains undefined.

4. Corporate Tax Reductions

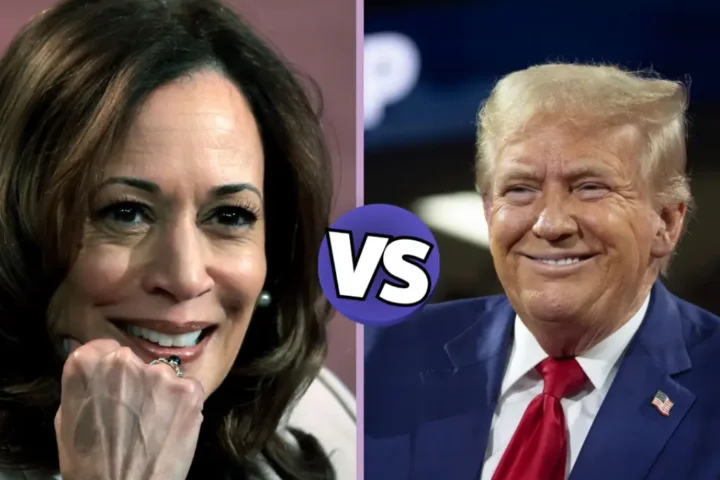

Corporation tax has also been reduced to 21% of the price from 35%, and Trump has recommended that it be cut to 15% for those manufacturers who produce their products in America to increase employment. This further enhances the 2017 tax slashes, where the corporate tax rate was lowered to 21% from 35%. His opponent, Kamala Harris, wants a higher corporations’ tax for large corporations for housing and family tax credit purposes.

5. SALT Deduction Cap

Another direction in Trump’s tax proposals is to eliminate the $10,000 SALT cap, which was introduced by the 2017 tax act. Currently, the cap is at $10,000, and due to this, it has led to increased taxes for some residents of high-end states, including New York and California. Many in these states support this proposal, but it is not well received among Republicans, who believe it will only favor the richest taxpayers.

6. Tariffs and Trade

During the campaign, Trump called for 100% tariffs on cars to protect American firms, including using an across-the-board tariff of perhaps as much as 20%. To this end, he says this would result in the creation of manufacturing jobs within the United States, hence assisting him in his quest to amass funds for his economic initiatives. However, many economists rattle that tariffs are capable of increasing prices and eventually causing inflation to hit consumers. For his part, Harris’ concerns have been the opposite of Trump’s tariff proposals, stating that it is a heaven-form sales tax for consumers in the United States.

The analysis of Trump’s tax proposal is still relevant today, especially regarding the ability of these policies to create jobs, build the economy, and sustain workers and businesses in the long term. Advertisement of these changes without consideration of the impact of the budgetary shortfall could prove difficult, especially for programs like Social Security.