Table of Contents

There are a lot of policies that one could buy for their family, and choosing the right product with the best benefits, a cheap premium, and favorable conditions can be a harrowing experience for all the insurers in the market. Of all these, Globe Life Insurance is a unique one because of its cheap, simple plans that people can explore without needing to take physical exams. Reading this article will help you know what needs to be expected from Globe Life Insurance in 2024, the pros and cons, as well as the qualities that make it different from others, for you to decide if it would work for you.

What is Globe Life Insurance?

Started in 1951, Globe Life Insurance provides term and whole life insurance coverage for customers and also their families throughout the United States of America. Often heard on its TV advertisements as ‘$1 starts your policy’, Globe Life guarantees insurance with no medical exam. This makes it stand out for those who require easy and cheap ways to access insurance products.

Key Features of Globe Life Insurance

1. No medical exam requirement

A major point of appeal in Globe Life is their policy, which does not require an applicant to pass a medical exam to receive the policy. This can be good news for those who might otherwise fail due to age or some other health issue.

2. Affordable Starting Premium

Starting with the policy costing $1, Globe Life proposes affordable life insurance to its customers. But it is critically important to know that an initial low rate means only the first month, and after that, the rates will be higher depending on age and type of policy.

3. Flexible Term and Whole Life Options

Globe Life has term and whole-life insurance products. Term insurance is comparatively cheaper than permanent insurance and meets the need for coverage for a pre-determined stipulated period, while permanent insurance includes the whole life, and other forms of permanent insurance design their benefits, which include lifelong coverage and locking of funds, which accumulate cash value over the life of the policy.

Types of Policies Offered by Globe Life Insurance

1. Term Life Insurance

Globe Life offers term life policies that pay a set amount of cash if the policyholder passes away during the policy’s set amount of time, which can typically be bought in five. The rates are likely to rise to the next five-year interval, usually as one grows older, making this a costly proposition in the long run. But it insures those undesired by other insurance providers young and healthy people, or those in need of cheap, temporary type of insurance.

2. Whole Life Insurance

Globe Life offers whole life insurance products that are specially designed for a client’s lifetime. They never increase during their term, and they also create cash value, which the owners may use in case of need by borrowing it.

3. Children’s Life Insurance

Otherwise known as characteristic nine, Globe Life also offers child coverage, offering policies specifically to lock in affordable lifetime insurance when a person is still young. These policies can also build up a cash value the amount that is useful for children in their later years.

Pros of Globe Life Insurance

- Simple Application Process: Since they do not require a client to undergo a medical exam, it is easy and fast to get insurance with this company.

- Affordability: Low start-up premiums as low as $1 are attractive to many individuals because of the tight financial plans that they have.

- Lifetime Options: It also provides whole-life policies for those in need of permanent insurance induction with cash value.

- Children’s Coverage: This is a company that targets young people with special policy options, which makes it a suitable company for early policy provision.

Cons of Globe Life Insurance

- Increasing Premiums for Term Policies: This first-time affordability may be lowered by the fact that premiums escalate after every five years.

- Limited Coverage Amounts: They contain rather limited coverage amounts compared to other carriers; hence, they may disappoint those with large exposures.

- Higher Rates for Older Individuals: Globe Life could also be more costly for older applicants, and the rates may be enough to raise issues about future sustainability.

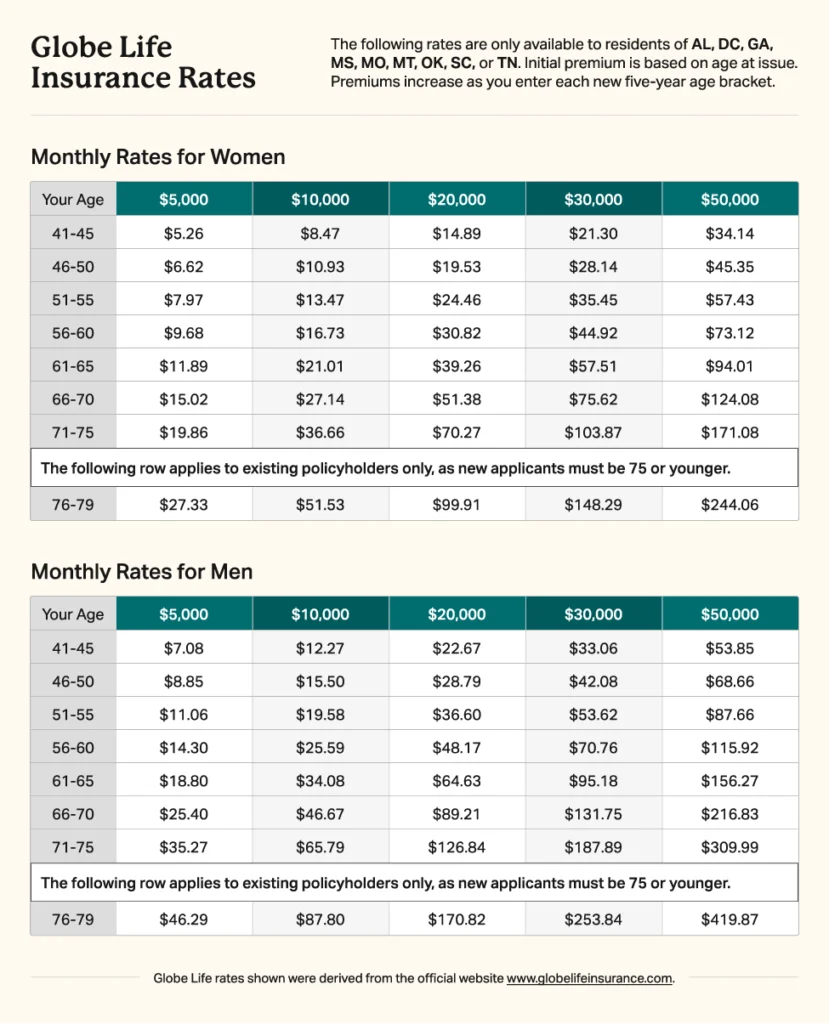

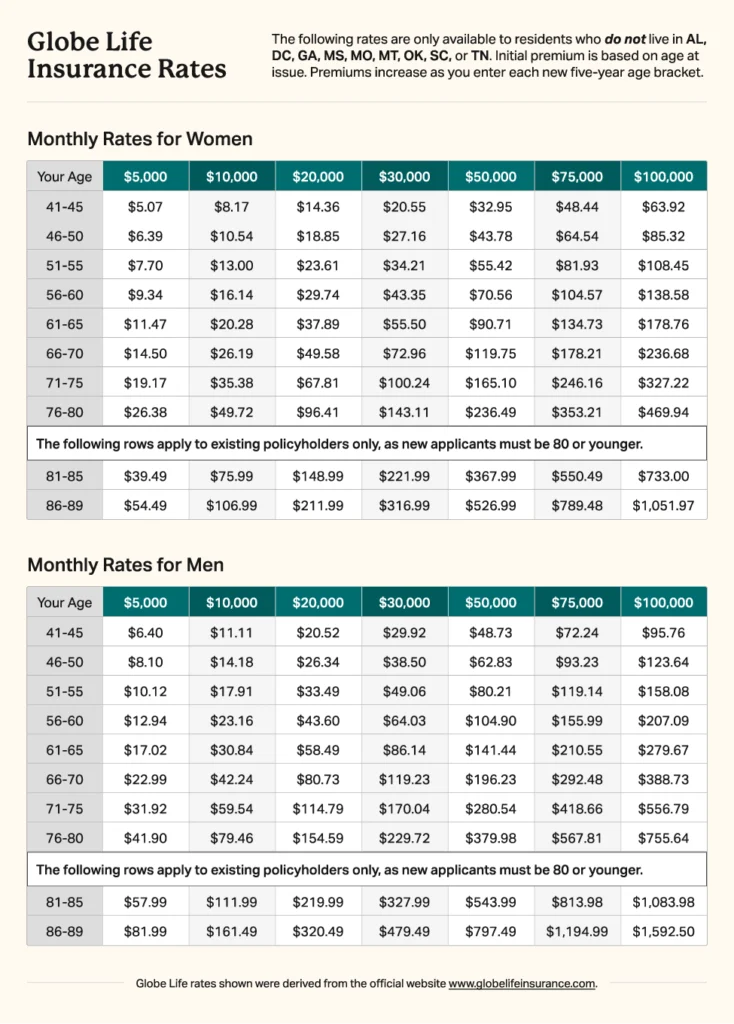

Price of Globe Life Insurance

Globe Life Insurance’s cost is generally low at first, primarily due to offers such as a $1 policy payment; however, it’s going to change based on age, health, and the coverage required. Here’s a general breakdown of the factors influencing the cost:

- Age: Young candidates have low rates of premium; however, rates rise every five years for term plans.

- Health Status: Applicants do not need a medical exam; however, those people who have chronic health conditions can be told to get more extensive coverage or choose other companies.

- Policy Type: They are more costly than term policies, but they are for the lifetime of the policyholder and include cash values.

Is Globe Life Insurance Good?

The answer varies, and it depends on your requirements and situations. Because it offers instant and convenient insurance without a medical examiner, Globe Life Insurance is much better for those who want fast coverage. It has policies that provide a wide range of options for families and individuals, especially those who want insurance at a cheaper price or want temporary insurance coverage. Nonetheless, where one is in search of high-value coverage or likely to require insurance for an extended period, the progressive increase in the rates of premium of term policies can be considered a disadvantage.

Consider Globe Life Insurance if:

- You require insurance fast and do not want to undergo a medical examination.

- You need one for a short period and can cope with rising rates.

- You need children’s life insurance or a plain whole-life policy with a cash-value component.

Consider other options if:

- For instance, to cover all your demands, you need a high coverage amount.

- You want a policy where the basic rates are constant for the long term.

- You are older and need cheaper solutions because even though Globe Life might offer great solutions, the premiums may also grow with age.

Globe Life Insurance is reliable, but you should know about insurance scams and protect yourself from falling prey to fraudulent schemes. There are many types of insurance scams people commit. If you don’t want to be one of them. Read This Article: Insurance Scams to Watch Out for and How to Protect Yourself

Globe Life Customer Experience and Reputation

It is also worth mentioning that Globe Life Company has no serious reputation issues and rather responds quickly to the customers’ inquiries as well as solving their problems related to policies. Nevertheless, the BBB rating of Globe Life depends on the state, and although the majority of consumers have positive experiences, some of the policyholders have complained about the rise of the rates. This is more so since performing a quick search to figure out Globe Life’s customer satisfaction rating in your state or area would prove useful.

Globe Life Insurance: Legit/ Scam!

Globe Life Insurance specializes in cheap yet highly comprehensive life insurance policies, especially for candidates who need insurance as soon as possible without passing a medical examination. However, though the entry cost is considerably low, for term policies, the cost rises with time and potentially affects the lifetime cost. For those who seek nothing more than a basic life insurance policy, Globe Life might very well be a good option; however, those with much larger obligations to cover or who rely on the stability of payments should consider other possibilities.

Thus, Globe Life Insurance is a company with many advantages but with certain disadvantages as well. After reading through this discussion, you may want to evaluate the needs you have in a company against what Globe Life has to offer to come to the right decision for you.

FAQ’s by Emma

Is it possible that I will be given Globe Life Insurance even if I have certain health problems?

Of course, it is for this reason that Globe Life does not demand a medical check-up, which is often a hurdle to policy issuance for many with medical complications. Nevertheless, the coverage amount may be restricted, together with the premium rates, depending on factors such as the age of the policyholder and the type of policy to be under.

When obtaining term insurance from Globe Life Insurance, is there any available cash value?

No, Globe Lifes term life insurance packages contain no aspect of cash values that are invested in other plans for future retirement. But if the construction of cash value is a goal, then look at their whole life coverage, which has lifetime protection, and the cash value, which can be taken during the insured’s lifetime.